The market for smart factories such as MES, ERP, PLM and other smart factories is estimated to be worth about US $154 billion in 2019 and will grow at a CAGR of close to 10% in 2019-2024.

The smart manufacturing platform market alone is worth $4.4 billion in 2019 and is expected to grow at a CAGR of 20% over the next five years.

Manufacturers plan to invest 3.24% of their income annually over the next three years. The planned investment is 1.7 times the amount invested in each of the past three years.

Manufacturers plan to build more than 40% of smart factories in the next five years, with annual investment increasing 1.7 times compared with the last three years.

These and many other insights come from the Capgemini Institute in a report titled "The Smart Factory Scale," a copy of which can be downloaded from the website. The study by Capgemini's research group found that the two main challenges to achieving

smart factory production levels are the integration of information technology (IT) and operational technology (OT) systems and the need for candidates looking for scope expertise, knowledge and skills to lead smart factories. Capgemini found there were challenges with good smart factory initiatives, with only 14 per cent of manufacturers feeling their initiatives were successful. Capgemini's study, which surveyed 1,000 manufacturers, focused on organisations that had already implemented smart factory initiatives. Pages 42-43 of the report set out the research methods. Key insights from the study include the following:

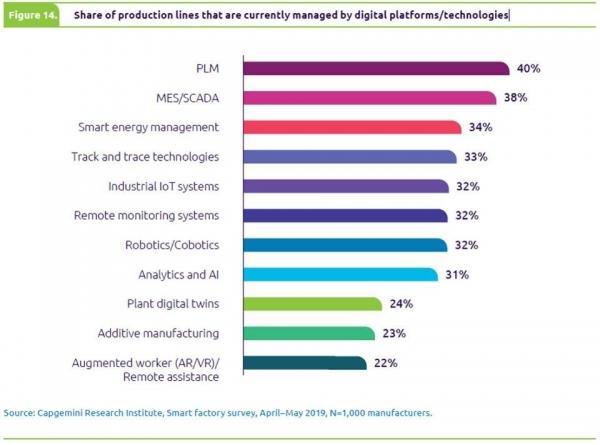

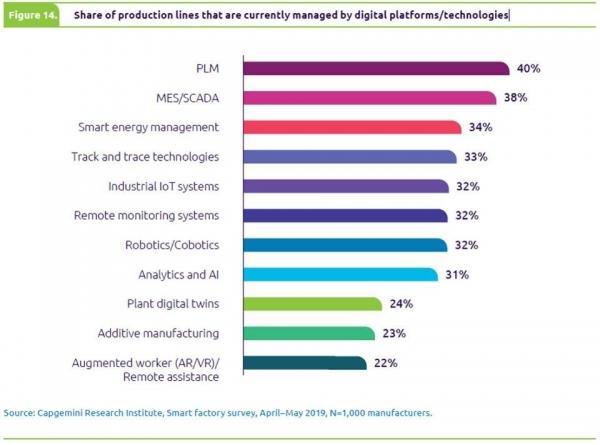

Manufacturing Execution Systems (MES), Monitoring and Data Acquisition (SCADA), and Product Lifecycle Management (PLM) systems are essential technologies for the success of smart factory initiatives. Manufacturers take a pragmatic, proven approach to defining and rolling out smart factory initiatives, relying on their own long-term systems that are used every day by operations teams. In the plastics manufacturing and processing industry, real-time monitoring is the road to light (or fully automated manufacturing transition). Manufacturing executives interviewed believe that real-time monitoring can provide real-time data streams with rich context that enable long-established technologies such as tracking/tracking and emerging technologies (analytics /AI, Industrial IoT, robotics and intelligent energy management) to deliver results.

Source: Capgemini Institute report "Smart Factory Scale"

China, Germany and Japan are the top three countries with the highest smart factory adoption index, followed by South Korea, the United States and France. Capgemini has built a smart factory using an index that ranks each country more accurately. Smart factories adopt a country or sector with an index greater than one indicating higher than average more aggressive expansion plans. Here are the scores for each country:

Source: Capgemini Institute report "Smart Factory Scale."

Nearly 70 percent of manufacturers are currently launching smart factory initiatives, a significant increase from 2017. Two years ago only 43 percent of manufacturers were launching smart factory initiatives. Today, 68 percent do. Most of the organisations that were planning smart factory initiatives two years ago (33 per cent) have now launched initiatives. Dr Seshu Bhagavatula is President of New Technology and Business Planning at Ashok Leyland, India's largest heavy duty vehicle manufacturer. "There are three main reasons for our smart factory initiative," he says. The first is to improve the productivity of our older plants through modernization and digital operations. The second is to deal with quality problems that are difficult for humans to detect. And the third is the ability for comprehensive customization or mass customization."

Source: Capgemini Institute report "Smart Factory Scale"

The power, energy and utility industries are by far ahead of other industries in smart factory progress and above the global average. Discrete manufacturers have the most ambitious plans, with 43 per cent of the industry's total production centres expected to be converted to smart factories within five years. Discrete manufacturing also outperformed other industries in the smart factory adoption index during the forecast period, further highlighting the industry's aggressive smart factory competition.

Source: Capgemini Institute report "Smart Factory Scale"

On average, 40% of production facilities now use MES/SCADA solutions. The same 40% use PLM for discrete manufacturing and consumer products. Newer solutions such as remote monitoring, mobile/augmented engineering (AR/VR) and manufacturing intelligence (from industrial IoT to analytics and AI) are still deployed at an average of two-thirds of the production line.

The share of production lines currently managed by digital platform technology. Source: Capgemini Institute report "Smart Factory Scale"

52% of manufacturers identified the integration of MES/SCADA systems with enterprise resource planning (ERP) as a key requirement for their smart plant initiatives. About half (48%) of manufacturers believe that integrated product life cycle management (PLM) systems are necessary for the success of smart factory initiatives. Surprisingly, only 40% of manufacturers launching smart factory initiatives have an end-to-end integration platform that spans devices to data analytics.

Source: Capgemini Institute report "Smart Factory Scale"

Three core technologies to achieve intelligent factory. The three core technologies are connectivity (leveraging the Industrial Internet of Things to collect data from existing devices and new sensors), intelligent automation (e.g., advanced robotics, machine vision, distributed control, unmanned aircraft), and cloud-scale data management and analytics (e.g., enabling predictive analytics /AI). Capgemini has found that these digital technologies will also enable IT-OT convergence, enabling end-to-end digital continuity from design to operation (digital twinning).

Fifty-five percent of manufacturers include new construction projects in their smart factory programs. Capgemini found that new construction was particularly prevalent among small - and medium-sized companies (those with annual revenues of less than $10 billion). For example, for companies with $5 billion to $10 billion in revenue, new projects accounted for 59 percent in 2019, compared with 50 percent in 2017.